Why Car Donation Beats Selling During Economic Uncertainty

When you're grappling with economic uncertainty, have you considered the benefits of donating your car instead of selling it?

The used car market can be volatile during these times, often leaving sellers short-changed. But there's a less unpredictable option, car donation! This route offers a guaranteed value that isn't subject to market fluctuations, providing much-needed assurance in an unstable economy.

On top of this, there are potential tax advantages to explore when donating a vehicle, enhancing its appeal even further.

Let's delve into why car donation might just beat selling in circumstances of economic uncertainty - from understanding market volatility and the consistent value donation offers to examining tax deduction perks and the convenience factor.

You'll gain industry-specific insights that could change your perspective on how best to handle your old vehicle amidst fluctuating financial climates.

Market Volatility

When the market's as unpredictable as a wild stallion, you'll find peace of mind in donating your used car rather than wrestling with erratic selling prices.

As economic uncertainty takes hold, values for second-hand vehicles can swing dramatically from one week to the next. It's a real gamble trying to get top dollar for your old ride when there's no telling what the market will look like tomorrow.

You could lose out on potential earnings if prices drop suddenly or struggle to find a buyer at all during downturns. But when you donate, you're guaranteed a certain level of value regardless of current trends.

So why risk it? In stormy seas, donation offers an anchor of stability that selling just can't match.

Donation Benefits

In times of financial instability, gifting your old ride offers a solid bang for your buck. Not to mention, it's a feel-good move that benefits worthy causes.

When you donate, the value isn't as capricious as the market price. The IRS allows deductions based on fair market value or selling price at auction, whichever is lower. This valuation method ensures you're not short-changed in unstable economic conditions.

On top of that, there's no dealing with fickle buyers, haggling over prices, or worrying about vehicle condition disclosures. Plus, numerous charities are eager to accept used vehicles - some even offer free towing! It streamlines the disposal process and puts your car to good use.

So during volatile times, consider donation; it's less risky and more rewarding than selling.

Guaranteed Value

You've got to admit, there's something reassuring about knowing the worth of your old set of wheels won't plummet overnight because of market instability.

When economic uncertainty hits, used car markets can be volatile and unpredictable, making it difficult for you to get a fair price for your vehicle.

Yet when you donate your car, this worry disappears. Car donation programs typically offer a guaranteed value based on the car's condition and age, not on fluctuating market conditions.

This means no matter what happens in the economy, you'll know exactly what your car is worth.

Donating also gives you valuable tax deductions which can offset any perceived loss from not selling. So during times of economic unpredictability, donating provides financial stability that selling simply cannot match.

Tax Deduction Advantages

Let's not forget, there's a sweet tax break waiting for you when you choose to donate instead of sell. This financial advantage can't be overlooked especially during periods of economic uncertainty.

- Itemization Advantage: If you itemize your taxes, the IRS allows a deduction equivalent to the fair market value of your car at donation time.

- Charitable Contribution: You're making a direct contribution to charity which is always tax-deductible.

- Avoid Sales Tax: Unlike selling where sales tax obligations may arise, donating eliminates this hassle.

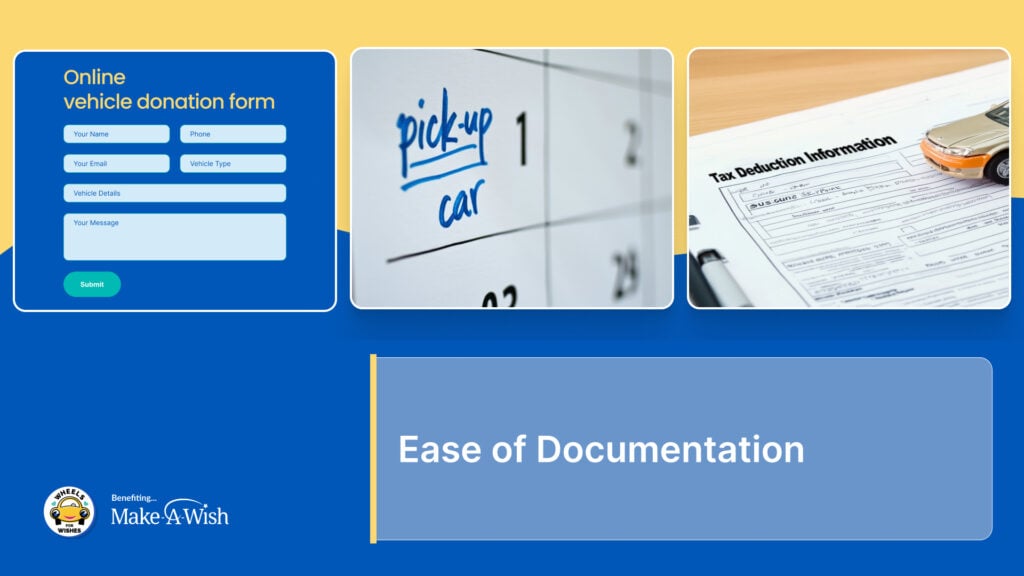

- Ease of Documentation: With reputable charities providing all necessary paperwork, claiming a deduction becomes hassle-free.

In essence, car donation not only offers guaranteed value but also substantial tax benefits that selling simply can't match during volatile times in used car markets.

Convenience of Donating

Imagine the ease of simply handing over your old set of wheels, as opposed to dealing with tire-kickers and no-shows that are all too common when trying to sell a used vehicle. Car donation services offer free pick-up and handle all the paperwork, saving you time and hassle.

You don't have to worry about haggling over prices or putting up advertisements. In uncertain economic times, where demand for used cars is volatile, donating can be a stress-free alternative. It sidesteps market unpredictability and guarantees you a certain value for your car in the form of tax benefits.

When selling becomes more trouble than it's worth, consider the convenience of car donation. It's an easy way to give back while getting rid of something you don't need anymore.