How Market Value Impacts Car Donations To Wheels For Wishes

When you donate a vehicle to Wheels For Wishes, you're not just supporting a great cause—you’re also potentially unlocking significant tax benefits for yourself. But how much your gift helps critically ill children and how much you may save on your taxes both depend on one key factor: your vehicle's market value.

Understanding this value is essential to having a rewarding and seamless donation experience.

The Role of Market Value In Car Donations

The market value of your car is the price it would likely bring in the current open market, based on factors such as make, model, year, mileage, condition, and local demand. For car donors, market value is more than just a sales number—it directly impacts:

- The proceeds from your donation, which fund life-changing wishes for children facing critical illnesses

- The tax deduction you may be eligible to receive

At Wheels For Wishes, we understand that determining your vehicle’s market value can be confusing, especially if you’ve never donated a car before. Our mission is to make this process easy, transparent, and rewarding for you.

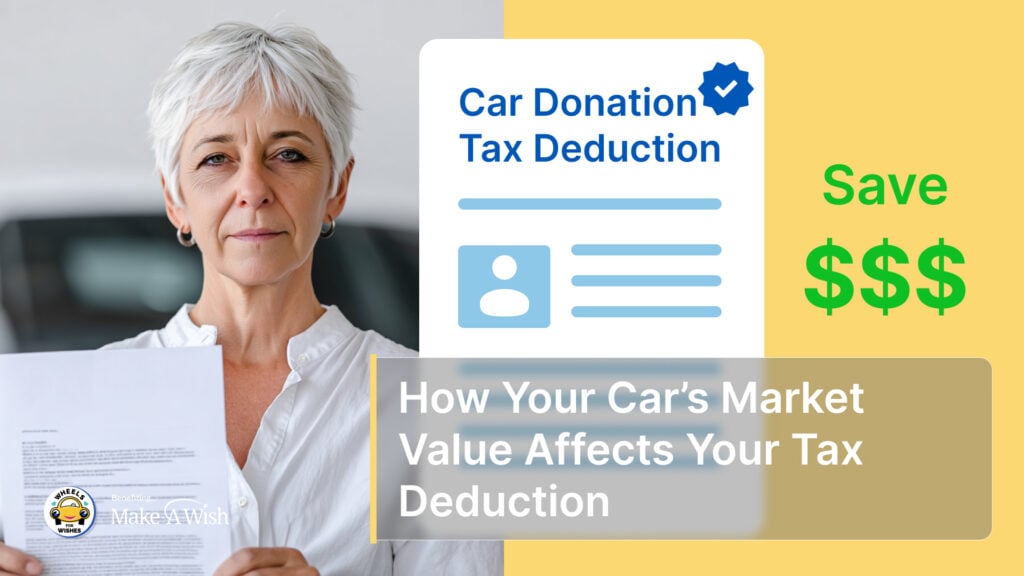

How Your Car’s Market Value Affects Your Tax Deduction

Your potential tax deduction for a donated car is generally based on the amount the vehicle sells for at auction or the fair market value under certain circumstances.

- If your vehicle sells for more than $500: The amount you can deduct is equal to the sale price, not the estimated value.

- If your vehicle sells for $500 or less: The IRS allows you to claim the fair market value up to $500, or the actual sale price if it’s less, whichever is greater.

- Exception — Significant Improvements: If we make a material improvement to your vehicle before the sale, or if we sell it to a person in need at below market value, you may be able to deduct the full fair market value.

By maximizing your vehicle’s market value, we maximize the impact of every donation and help you achieve a larger tax benefit.

Tools And Resources For Estimating Vehicle Market Value

If you’d like an idea of what your tax deduction may be before donating, consider using these reputable online resources:

- Kelley Blue Book (KBB): kbb.com lets you look up trade-in and private party values based on your car’s details and condition.

- Edmunds: edmunds.com offers free car appraisal tools.

- NADA Guides: nadaguides.com gives estimates for market value, especially for older or specialty vehicles.

Keep in mind, actual sale prices at auction may vary, and Wheels For Wishes will provide you with a tax receipt showing your vehicle’s sale price after the donation process is complete.

How Wheels For Wishes Maximizes Vehicle Value

We treat every car donation on a case-by-case basis, aiming to get the best possible result for our donors and the children we serve. Here’s how our experience works for you:

- Expert Appraisal: Our team evaluates each vehicle to determine the best route—auction, recycling, or scrapping—to maximize its value.

- Wide Network: We work with a network of licensed auctions, recyclers, and salvage yards across the country, ensuring each vehicle reaches its most valuable outlet.

- Professional Processing: Whether your car is running, non-running, old, or lightly used, we handle the logistics to secure the greatest return.

- No Hassle For Donors: We help manage all the paperwork, title transfer, auctioning, and compliance with tax regulations—saving you time and eliminating stress. The amount of paperwork we are able to help with depends on local and state laws and regulations.

The Full-Service Car Donation Experience

When you choose Wheels For Wishes, you’re selecting a program with:

- Free towing: We arrange complimentary pick-up of your vehicle, no matter its condition or your location.

- Comprehensive paperwork support: We provide IRS-compliant tax receipts and walk you through the steps, so you don’t have to guess or worry.

- Personalized donor service: Our team is always available to answer your questions and ensure your donation is smooth and rewarding.

All you need to do is contact us or submit our quick online form—after that, we handle everything.

Your Donation’s Bigger Impact

Every dollar raised from your car’s sale goes toward granting wishes for critically ill children through the Make-A-Wish foundation. The higher the value we can get for your vehicle, the more life-changing experiences we can create for kids—and the higher your potential tax benefit.

Ready To Donate? Let’s Get Started

If you have questions about your car’s market value, the donation process, or how your tax deduction works, we're here for you every step of the way. Check your vehicle’s estimated value using online tools, then reach out to Wheels For Wishes to get started.

We make car donation easy, maximize your benefits, and transform your generosity into hope and joy for children who need it most.

Donate your car today and experience for yourself how a simple vehicle donation can make a meaningful difference.